Introduction

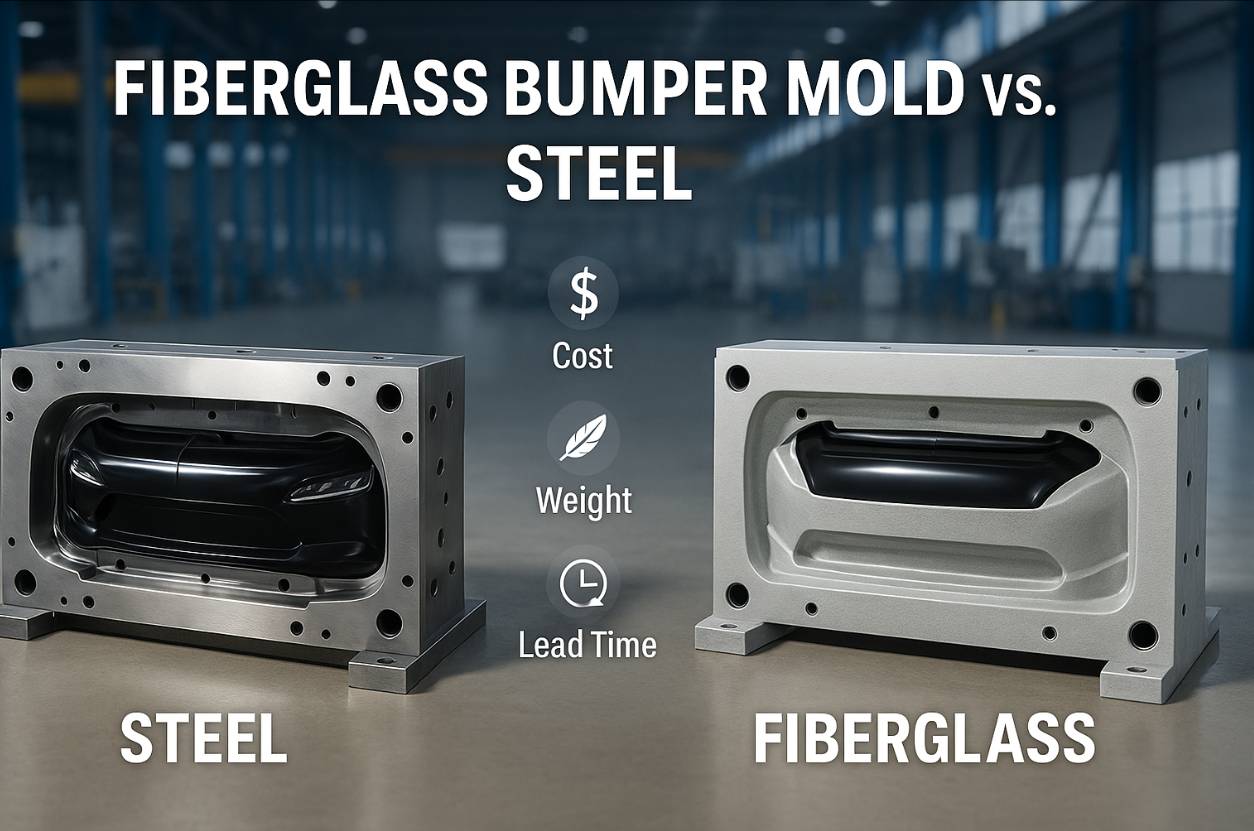

When an automotive OEM specs a new bumper program, the first tooling decision is often material. Should you invest in a traditional steel mold or switch to a modern fiberglass bumper mold? That choice ripples through tooling budget, launch schedule, operator safety, and even CO₂ footprint.

As an ISO‑certified pultrusion manufacturer, Unicomposite has built composite tooling for industries ranging from cooling‑tower fan stacks to Class‑8 truck fascias. Drawing on that plant‑floor experience—and the latest market data—we’ll compare fiberglass and steel bumper molds so you can order the right tool the first time.

fiberglass bumper mold

Understanding Bumper Mold Materials

Performance Requirements in Automotive Bumper Production

Crash‑energy absorption, Class‑A paint finish, and ±0.25 mm repeatability put serious demands on bumper molds. Designers also juggle throughput targets of 30–60 shots /hr and tool life measured in the tens of thousands of cycles.

Steel Molds: Properties, Typical Lifespan, Common Use Cases

Tool steels (P20, H13) thrive in high‑cavitation, multi‑million‑shot programs thanks to Rockwell hardness above 28 HRC. A well‑maintained steel bumper die can survive well past 1 million cycles but requires CNC machining, EDM burn‑in, and frequent anti‑corrosion sprays.

Fiberglass Molds: Composition, Pultrusion/Hand‑Lay‑Up Methods, Ideal Scenarios

A fiberglass bumper mold is usually a glass‑fiber laminate reinforced with stitched mat and a high‑temperature vinyl‑ester or epoxy resin. Pultrusion yields long, straight cavities; hand‑lay‑up or vacuum infusion covers complex 3‑D surfacing. Global demand for fiberglass molds hit USD 340.9 million in 2023 and is forecast to grow 4.7 % CAGR through 2030. A Fibreglast technical brief adds that composite molds are “far less expensive to fabricate and maintain” than aluminum or steel tooling.

Head‑to‑Head Comparison: Fiberglass vs. Steel

Total Cost of Ownership (startup tooling + maintenance)

Up‑front machining charges for a large steel bumper mold often exceed USD 100 k. By contrast, shops report composite bumper tools landing 25–40 % lower because they eliminate hard milling and prolonged heat‑treat cycles. Steel also demands longer press warm‑ups, which can raise annual electricity costs. Industry blogs note that steel molds cost more than aluminum—and by extension fiberglass—because of higher tooling hours and slower cooling.

Lead Time & Design Flexibility — anonymized Tier‑1 OEM case study

A simple steel mold typically ships in 6–8 weeks, whereas a composite bumper tool of similar complexity can be pulled in 2–4 weeks thanks to faster lay‑up and room‑temperature cure. One Tier‑1 supplier for a European EV program cut launch lead time by 21 days by moving its prototype bumper skins to a fiberglass tool, allowing earlier paint trial runs and customer clinics.

Durability, Repairability & Downtime — expert quote

Steel wins outright in ultra‑high‑volume programs, but composite tools hold their own. A plant engineering manager quoted by Composites One notes that prepreg composite tools deliver “good surface durability, up to 300+ cycles with simple routine maintenance.” When damage does occur, technicians can buff and re‑laminate localized patches in hours instead of shipping 1‑ton die halves out for welding.

Production Performance for OEMs

Volume Thresholds: Low‑/Mid‑Volume Advantage of Fiberglass

If your annual demand is below ~50 k bumpers, amortizing a fiberglass bumper mold is usually cheaper than running a hardened steel die. That makes composites attractive for niche models, aftermarket fascias, or regional restyle programs.

Surface Finish, Paint Readiness & Dimensional Tolerances

Modern fiberglass tooling gels and post‑cures achieve mirror finishes < 0.4 µm Ra. OEM auditors routinely approve Class‑A panels after a single polish cycle. Built‑in CTE compatibility between fiberglass and SMC/BMC bumper substrates also cuts warpage scrap.

Ergonomics & Safety: Weight Reduction, Easier Handling

Fiberglass laminate density hovers near 1.9 g/cm³—roughly 75 % lighter than steel—so a bumper tool that would weigh 4 tons in steel may drop to 1 ton in composite. Unicomposite field data shows crews lifting mid‑size hood molds with an overhead hoist rated for 1 t, slashing crane rental fees and reducing OSHA recordable overexertions Unicomposite. Lighter tools also accelerate change‑overs, boosting overall equipment effectiveness.

Sustainability & Compliance Factors

Carbon Footprint, Energy Use, and End‑of‑Life Scenarios

Producing one tonne of traditional blast‑furnace steel releases about 1.8 t CO₂, while the equivalent mass of glass‑fiber‑reinforced plastic generates just 0.18 t CO₂—a 90 % reduction. Because fiberglass molds run at lower press temperatures and cool faster, each cycle also draws less electricity, trimming Scope 2 emissions over thousands of shots.

Meeting ISO/TS 16949, FMVSS, and REACH

Steel and fiberglass molds can both deliver parts that meet FMVSS 581 bumper‑impact requirements; the difference lies in process control. Unicomposite’s ISO processes and traceable PPAP documentation give procurement teams the audit trail they need. For EU customers, the absence of hexavalent‑chromium plating on fiberglass tooling simplifies REACH compliance and eliminates hazardous‑waste streams.

Decision Framework for Engineering & Procurement Teams

Quick ROI Calculator Inputs (cycle time, scrap rate, mold life)

Start with three levers: cycle time (sec/shot), scrap rate (%), and expected mold life (cycles). In our in‑house dashboard, dropping steel cycle time from 55 s to 42 s with fiberglass saved an assembly plant USD 78 k/year in press uptime.

Supplier Qualification Checklist — highlight Unicomposite’s capabilities

Verify ISO certification and in‑house machining for steel sub‑frames.

Request a CTE‑matched resin recommendation (e.g., low‑shrink vinyl‑ester for Class‑A).

Ask for sample PPAP or ISIR packs.

Inspect past automotive reference parts—Unicomposite’s portfolio spans power‑utility insulators to cooling‑tower louvers, demonstrating cross‑market expertise.

Risk Mitigation: Backup Tooling, Hybrid Strategies, Contract Clauses

For launches above 100 k units, consider pairing one steel master die with a fiberglass “sprint” tool for service parts or color variants. Contract clauses should spell out repair turn‑times (< 48 h for fiberglass) and set maximum press‑down hours before preventive maintenance.

Conclusion

Steel still dominates marathon production runs, but for agile, low‑ to mid‑volume programs a fiberglass bumper mold often wins on lead time, tooling budget, operator ergonomics, and sustainability. If you’re evaluating a new fascia program, talk to an experienced composite partner such as Unicomposite to run a fast ROI scenario and outline material choices. Ready to validate a design? Request a technical consultation or quote today.

Frequently Asked Questions

Q1. How many parts can a fiberglass bumper mold realistically produce?

With routine waxing and minor surface touch‑ups, shops report 300–500 cycles before a full repolish—enough for most prototype and regional programs.

Q2. Can I weld or patch a damaged fiberglass tool?

You can’t weld composites, but technicians can sand away a defect and re‑laminate glass cloth and resin, often in a single shift.

Q3. Does switching to fiberglass affect bumper impact performance?

No. The mold material does not dictate part strength; your bumper’s crash compliance depends on the molding compound and design, both of which remain unchanged.

Q4. What tolerances can I hold with composite molds?

±0.25 mm is common on Class‑A fascias when the tool is post‑cured and supported by a rigid steel frame.

Q5. How quickly can I get a replacement or spare tool?

Because fiberglass molds cure at ambient temperatures, a replacement cavity can usually be delivered in two to four weeks—half the time of a steel die.

info@unicomposite.com

info@unicomposite.com